This story was originally published here.

In a mid-May video conference with the Peterson Institute for International Economics, Federal Reserve Chairman Jerome Powell succinctly vetoed an idea that had been weighing on the minds of treasury bond traders for years.

“The committee's view on negative rates has not changed. This is not something we're looking at,” he told the audience.

Even though the U.S. economy is struggling through a severe recession during an extended period of abnormally low-interest rates, the Fed refuses to take its benchmark interest rate into negative territory, fearing that below-zero rates could upend the money market.

While this position might sound reassuring, it actually has sobering implications for the markets long-term treasury bonds, which has seen four decades of almost continuous growth because of falling yields.

The 40 Year Bull Market in Long-Term Treasury Bonds

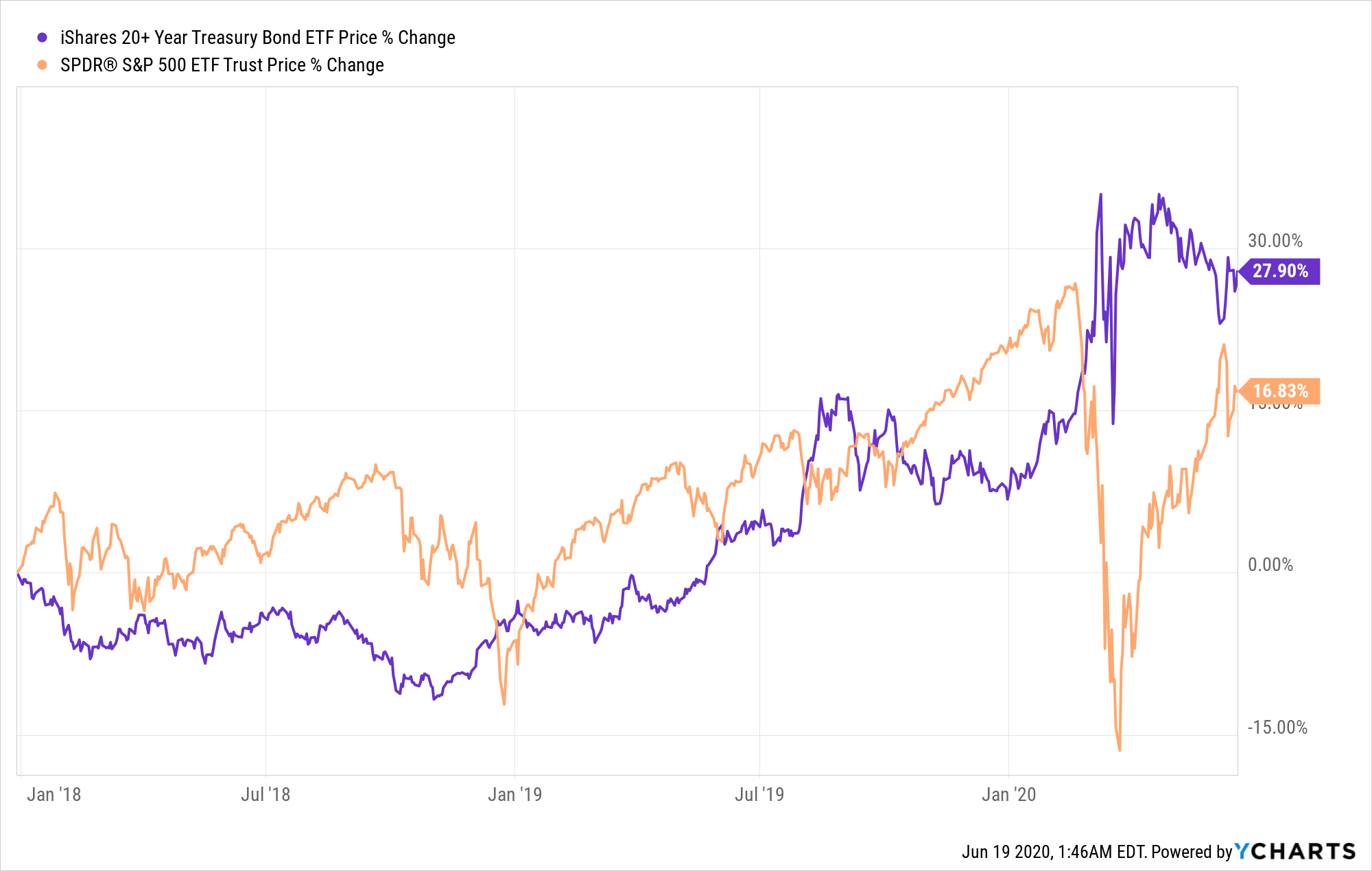

Long-term treasury bonds have been a fantastic investment for most of the last half-century — largely because their prices are negatively correlated with U.S. stocks.

In fact, since the beginning of 2018, the iShares 20+ Year Treasury Bond ETF (NYSE: TLT) has outperformed the S&P 500.

Due to the nature of bond markets, the 40-year-long bull market in long-term treasuries has also brought a 40-year-long decline in the interest rates on these bonds.

The 30-year Treasury yield hit a high of 15% in 1981, but today it’s consistently below 2%. How did it drop so low?

The simple answer is that the bond market made it so. A bond’s yield is simply a conceptual ratio equal to its annual dollar payout — which is fixed — divided by its market price. As traders bid up the price of a bond, its yield falls since its payout doesn’t change.

And for the last 40 years, traders have bid up the price of long-term treasury bonds on a near-consistent basis, leading to steadily falling yields.

But there’s a bit more to this market behavior than meets the eye…

Editor's Note: Click here to keep reading.

UPSET ALERT: Tiny firm set to win race to deploy 5G

We’ve all heard about investing in 5G.

But while everyone is talking about the fancy new 5G chips or antennas…

Nobody’s talking about the most significant piece of the 5G puzzle…

The web of networking cables crisscrossing the country that will bring information from all over the world right to your fingertips.

This is the backbone of America’s 5G network.

It simply can’t be built without those fiber-optic connections.

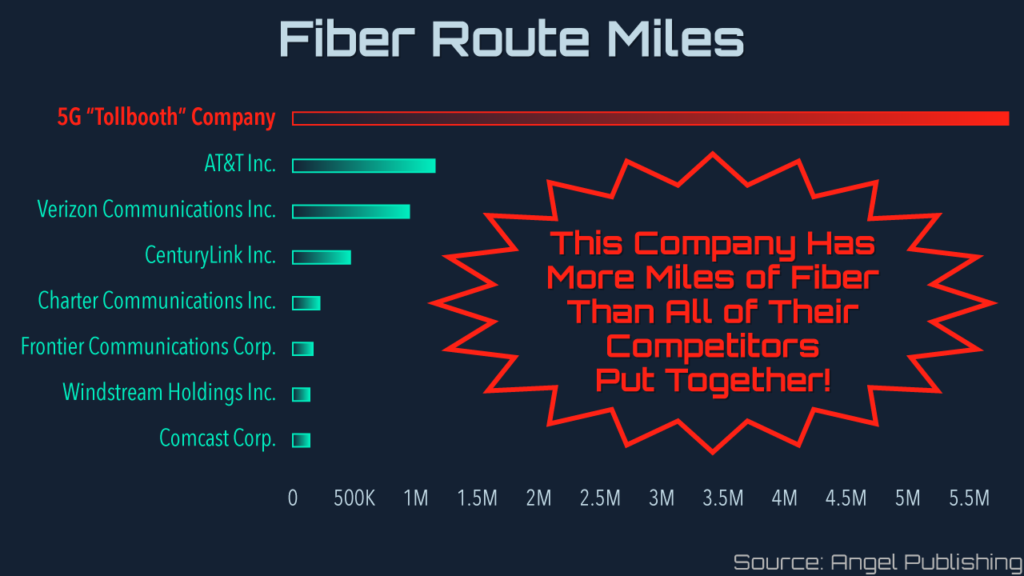

And there’s one company that literally owns this entire fiber network.

All of the wireless carriers and pretty much every big name in communication already have contracts in place with this company.

In fact, the ONLY cities in the entire country with 5G coverage are located right on this company’s fiber network.

Even the U.S. government is paying to get its secured communications on this critical piece of infrastructure.

Quite simply: This company owns more fiber networks than anyone else in America.

It is the critical piece for winning the race to deploy 5G.

And best of all, this company’s stock is trading around $10 a share.

But according to my research, you could be sitting on more than 600% profits after all’s said and done.

This company is leading the charge to 5G and could make early investors filthy rich.

Click here to get the name and ticker symbol.

Good investing,

Brit Ryle

Investment Director, The Wealth Advisory