Utility stocks can make excellent investments for long-term dividend growth investors.

Durable, regulatory-based competitive advantages allow these companies to consistently raise their rates over time. In turn, this allows them to raise their dividend payments year in and year out.

Even better, many utility stocks have above-average dividend yields, providing a compelling combination of income now and growth later for long-term investors.

Because of these favorable industry characteristics, we’ve compiled a list of utility stocks. The list is derived from the major utility sector exchange-traded funds JXI, VPU and XLU.

You can download the list of all utility stocks (along with important financial ratios such as dividend yields and payout ratios) by clicking on the link below:

Keep reading this article to learn more about the benefits of investing in utility stocks.

Why Utility Dividend Stocks Make Attractive Investments

The word ‘utility’ describes a wide variety of business models but is usually used as a reference to electric utilities – companies that engage in the generation, transmission, and distribution of electricity.

Other types of utilities include propane utilities and water utilities.

So why do these businesses make for attractive investments?

Utilities usually conduct business in highly regulated markets, complying with rules set by federal, state, and municipal governments.

While this sounds highly unattractive on the surface, what it means in practice is that utilities are basically legal monopolies.

The strict regulatory environment that utility businesses operate in creates a strong and durable competitive advantage for existing industry participants.

For this reason, electric utilities are among the most popular stocks for long-term dividend growth investors – especially because they tend to offer above-average dividend yields.

Indeed, the regulatory-based competitive advantages available to utility stocks give them the consistency to raise their dividends regularly.

Simply put, utility stocks are some of the most dependable dividend stocks around.

To provide a few examples, the following utility stocks have exceptionally long streaks of consecutive dividend increases:

- Consolidated Edison (ED) – more than 25 years of consecutive dividend increases

- American States Water (AWR) – a water utility – more than 50 years of consecutive dividend increases

- SJW Group (SJW) – another water utility – more than 50 years of consecutive dividend increases

The long streak of consecutive dividend increases is possible only because of their unique industry-specific competitive advantages.

Clearly, the utility sector is very stable. People are going to need electricity and water in ever-increasing amounts for the foreseeable future.

One characteristic that does not describe utility stocks is high growth. One of the regulatory constraints imposed upon utility companies is the pace at which they can increase the fees paid by their customers.

These rate increases are usually in the low-single-digits, which provides a cap on the revenue growth experienced by these companies.

Utility stocks typically don’t offer strong total returns, but there are exceptions.

The Top 10 Utility Stocks Now

Taking all of the above into consideration, the following section discusses our top 10 list of North American utility stocks today, based on their expected annual returns over the next five years.

The top 10 list was screened to include only Dividend Risk scores of A or B, to focus on quality companies with safe dividends.

The 10 utility stocks with the highest projected five-year total returns are ranked in this article, from lowest to highest.

Rankings are compiled based upon the combination of current dividend yield, expected change in valuation, as well as expected annual earnings-per-share growth.

This determines which utility stocks offer the best total return potential for shareholders.

Top Utility Stock #10: Edison International (EIX)

5-year expected annual returns: 6.5%

Edison International is a renewable energy company that is active in energy generation and distribution. Edison

International also operates an energy services and a technologies business. The company was founded in 1987 and is

headquartered in Rosemead, CA. Total revenue is over $15.4 billion.

Edison International remained highly profitable during the last financial crisis, as the company’s earnings-per-share declined by just 12% between 2008 and 2009 and started to rise again during 2010. Edison International is thus not impacted by the strength of the economy to a significant degree.

Its non-regulated segments, such as renewable energy production via methods ranging from biomass to wind energy, has the potential to grow at a somewhat higher rate. Due to being non-regulated, this business can be more cyclical than the regulated utility operations. Edison has put a focus on renewable energy when it comes to energy production over the last decades

We expect annual returns of 6.5% per year, due to 5.5% EPS growth, the 4.2% dividend yield, and a ~3.2% annual reduction from a declining P/E multiple.

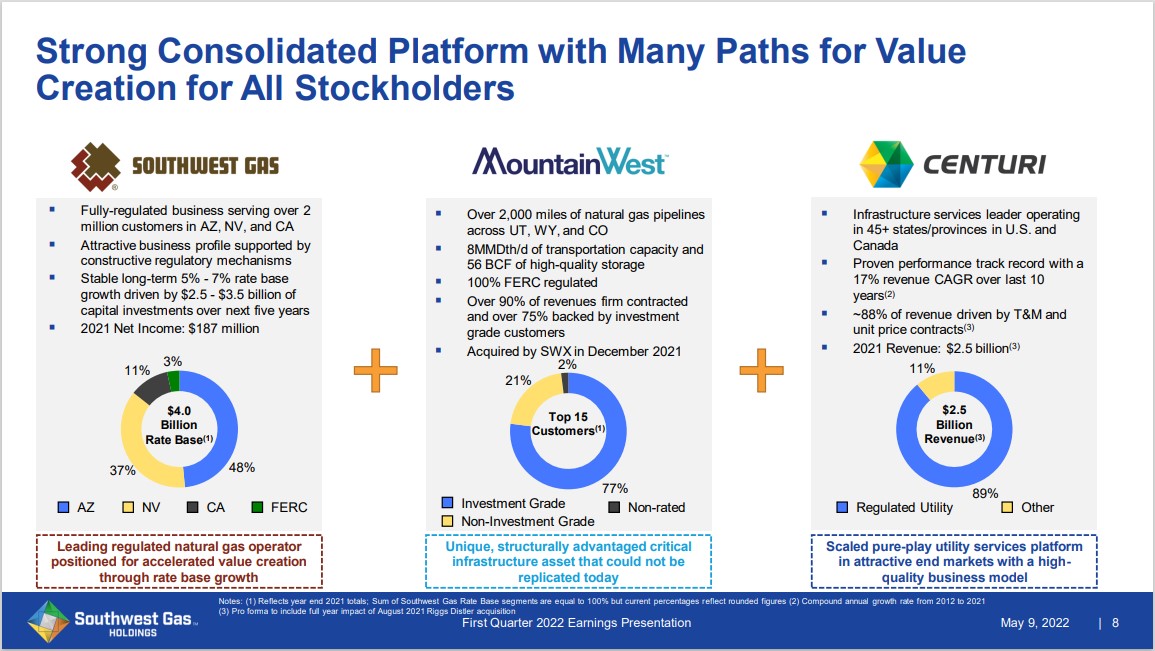

Top Utility Stock #9: Southwest Gas Holdings (SWX)

5-year expected annual returns: 6.7%

Southwest Gas Holdings Inc. is a holding company that operates in two business segments, Natural Gas Operations and Utility Infrastructure Services.

The Natural Gas business, Southwest Gas Corp., purchases, distributes and transports natural gas in Arizona, California and Nevada and serves over 2 million customers.

The corporation also owns and operates an interstate pipeline through their subsidiary Paiute Pipeline Company. Paiute also runs a peak shaving LNG storage facility.

The Utility business, Centuri Group Inc. delivers a multitude of energy solutions to North America’s gas and electric providers. Centuri operates in 40 states and provinces in the U.S. and Canada.

We expect 6.7% annual returns, due to 5% annual EPS growth, the 2.7% dividend yield and a ~1% annual decline from a contracting P/E multiple.

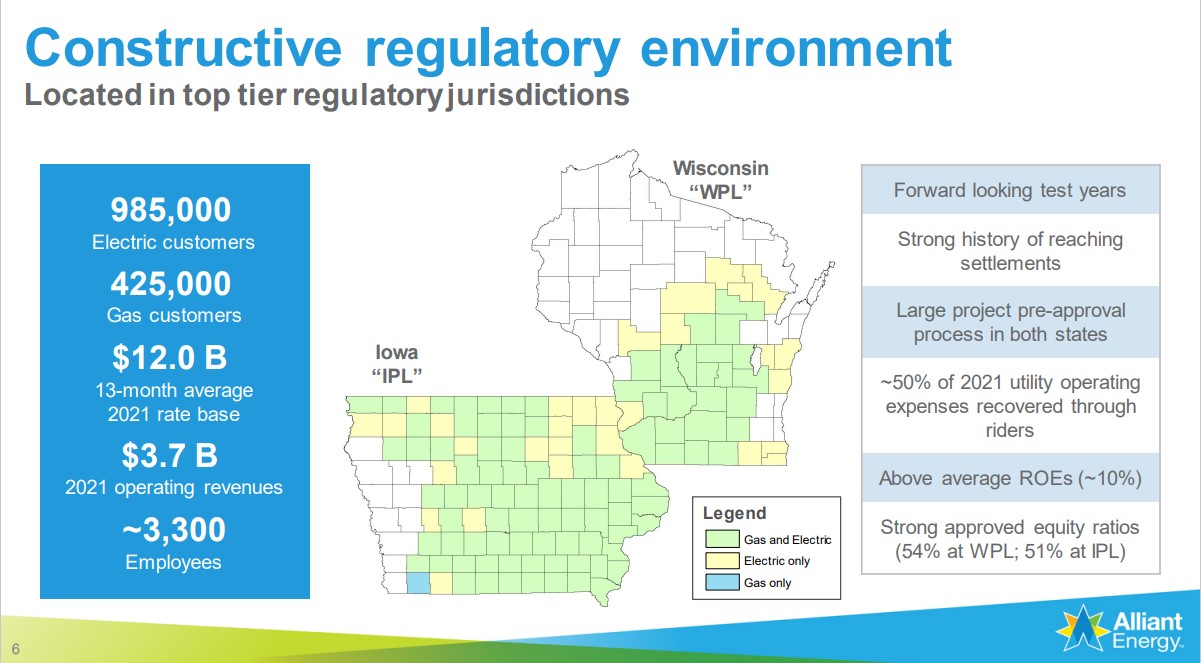

Top 10 Utility Stock #8: Alliant Energy (LNT)

5-year expected annual returns: 6.9%

Alliant Energy Corporation is a public utility holding company incorporated in Madison, Wisconsin, in 1981. In 2020, Alliant Energy generated $3.7 billion in operating revenues. The company serves approximately 970,000 electric and 420,000 natural gas customers. Alliant has about 3,600 employees.

The company consists of three subsidiaries. The first is the largest, Interstate Power and Light Company (IPL), which accounted for 53.2% of Alliant’s 2021 earnings. IPL is a public utility that generates and distributes electricity and distributes and transports natural gas in Iowa.

The second subsidiary is Wisconsin Power and Light Company (WPL), which provides similar services to IPL in southern and central Wisconsin. WPL contributed 40.1% of total 2021 earnings. The last is Corporate Services, which account for a tiny percentage of the company’s total earnings.

We expect annual returns just below 7% per year for LNT stock. This will be derived from expected EPS growth of 6% per year, the 2.8% dividend yield, and a ~1.8% annual reduction from a declining P/E multiple.

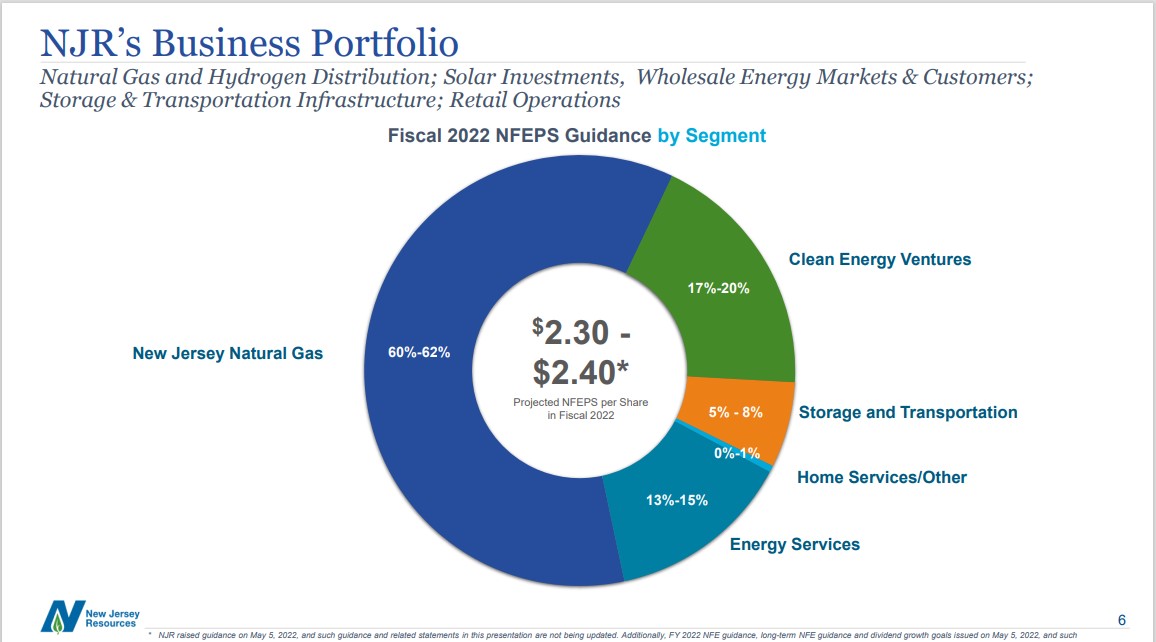

Top Utility Stock #7: New Jersey Resources (NJR)

5-year expected annual returns: 6.9%

New Jersey Resources provides natural gas and clean energy services, transportation, distribution, asset management and home services through its five main subsidiaries. The company owns both regulated and nonregulated operations.

NJR’s principal subsidiary, New Jersey Natural Gas (NJNG), owns and operates over 7,600 miles of natural gas transportation and distribution infrastructure serving over half a million customers. NJR Clean Energy Ventures (CEV) invests in and operates solar projects, to provide customers with low-carbon solutions.

NRJ Energy Services manages a portfolio of natural gas transportation and storage assets, as well as provides physical natural gas services to customers in North America. The midstream subsidiary owns and invests in several large midstream gas projects.

Finally, the home services business provides heating, central air conditioning, water heaters, standby generators, and solar products to residential homes. New Jersey Resources was founded in 1952 and has paid a quarterly dividend since.

The company has increased its annual dividend for 25 consecutive years, qualifying the company as a Dividend Champion. We expect annual returns of nearly 7% per year for New Jersey Resources.

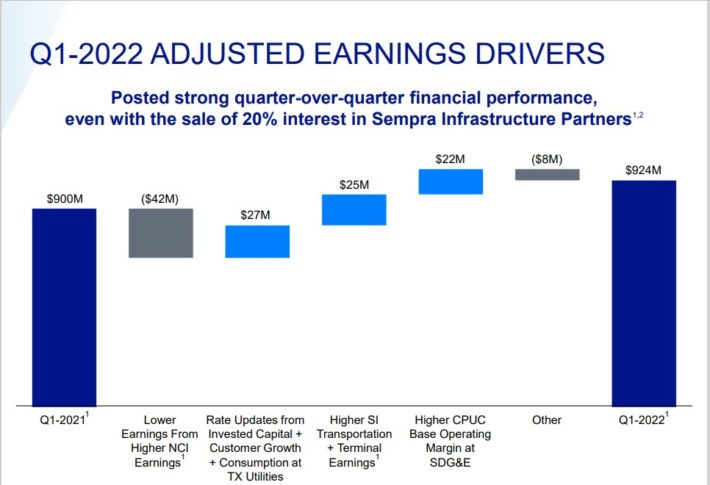

Top Utility Stock #6: Sempra Energy (SRE)

5-year expected annual returns: 7.1%

Sempra Energy has grown into a ~$51 billion market cap company. It serves one of the largest utility customer bases in the U.S., as it distributes natural gas and electricity in Southern California (over 20 million customers) and owns a majority stake in Texas-based Oncor, a transmission and distribution business (over 10 million customers).

The company also owns and operates other utilities and merchant renewable energy projects, liquefied natural gas facilities, and gas pipes and storage in the U.S. and Latin America.

Sempra Energy benefits from two key trends, namely the transition towards cleaner energy resources and the advance of the U.S. as a global energy leader. In 2018, the company sold most of its non-core assets in order to better focus on its large core North American regulated utility, LNG export, and Mexican infrastructure (IEnova) assets as well as deleverage the balance sheet. Given the strong competitive advantages enjoyed by these core assets, we believe that these moves have made Sempra Energy more attractive.

In early May, Sempra Energy reported (5/5/22) financial results for the first quarter of fiscal 2022.

Adjusted earningsper-share dipped -1%, from $2.95 to $2.91, but beat analysts’ estimates by $0.15. Business outlook remains positive.

The company raised the dividend by 4.1% this year and reaffirmed its guidance for annual earnings-per-share of $8.10-$8.70 in 2022 and $8.60-$9.20 in 2023. It is also remarkable that Sempra Energy has exceeded analysts’ earnings-per-share estimates in 13 of the last 15 quarters.

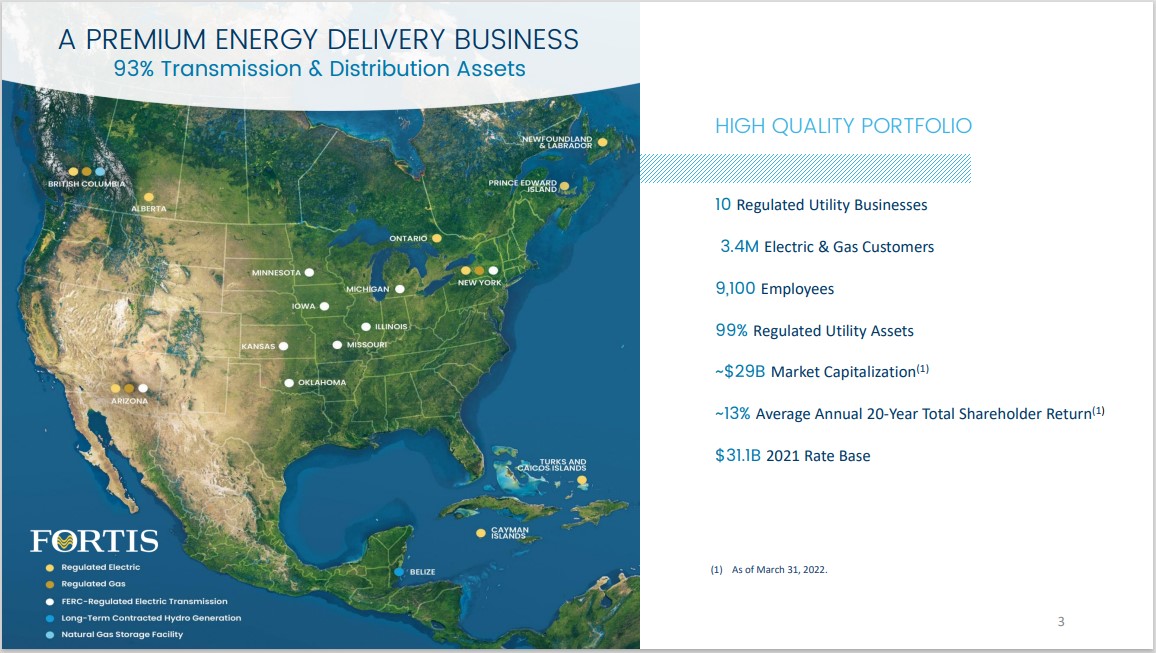

Top Utility Stock #5: Fortis Inc. (FTS)

5-year expected annual returns: 8.1%

Fortis is Canada’s largest investor-owned utility business with operations in Canada, the United States, and the Caribbean. It is cross-listed in Toronto and New York. Fortis trades with a current after-tax yield of 2.9% (about 3.4% before the 15% withholding tax applied by the Canadian government).

At the end of 2021, Fortis had C$58-billion of assets. 63% were in the U.S., 34% in Canada, and 3% in the Caribbean; 82% of assets were regulated electric utility assets, 17% were regulated gas, and only 1% were nonregulated.

Fortis reported stable Q1 2022 results on 05/04/22. For the quarter, it reported adjusted net earnings of C$350 million, down 1.4% versus Q1 2021. Adjusted net earnings increased 2.5% to C$369 million, while adjusted earnings-per-share (EPS) rose 1.3% to C$0.78.

The utility invested C$1.0 billion for its capital spending for the quarter, which is on track for this year’s spending of $4.0 billion in this area. Management also announced a long-term ESG goal of achieving net-zero emissions by 2050, building on its mid-term 2035 target to reduce GHG emissions by 75%.

We expect annual returns of 7.8% per year, due to 6% expected EPS growth, the 3.4% dividend yield and a ~1.6% boost from an expanding P/E multiple.

Top Utility Stock #4: Eversource Energy (ES)

5-year expected annual returns: 9.3%

Eversource Energy is a diversified holding company with subsidiaries that provide regulated electric, gas, and water distribution service in the Northeast U.S. The company’s utilities serve more than 4 million customers after acquiring NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gas in 2020. The company was formerly known as Northeast Utilities and changed its name to Eversource Energy in April 2015.

Eversource has grown its dividend by a 5%-7% average rate since 2018.

On May 4th, 2022, Eversource Energy released its first-quarter 2022 results. For the quarter the company reported revenue of $3.47 billion, an increase of 22.8% versus Q1 2021, and adjusted earnings per diluted share of $1.28, up 21% versus Q1 2021. All segments contributed to strong year-over-year earnings growth.

In the electric distribution and natural gas distribution segments, the increase was primarily due to higher revenues and lower pension costs. An investment in Eversource’s transmission facilities contributed to higher earnings in this segment. Operating expenses increased nearly 25.4% year over year to $2,808 million.

Eversource Energy has the ambition to invest $18.1 billion in different projects (transmission, electric distribution) in the 2022-2026 timeframe, which will support its goal to be carbon neutral by 2030. Most notably, the company is planning to add 1,758 megawatts of offshore wind through a joint venture, by 2025. The company expects earnings per share to grow at a 5% to 7% compound annual rate from 2022 through 2026, the same as for dividend growth.

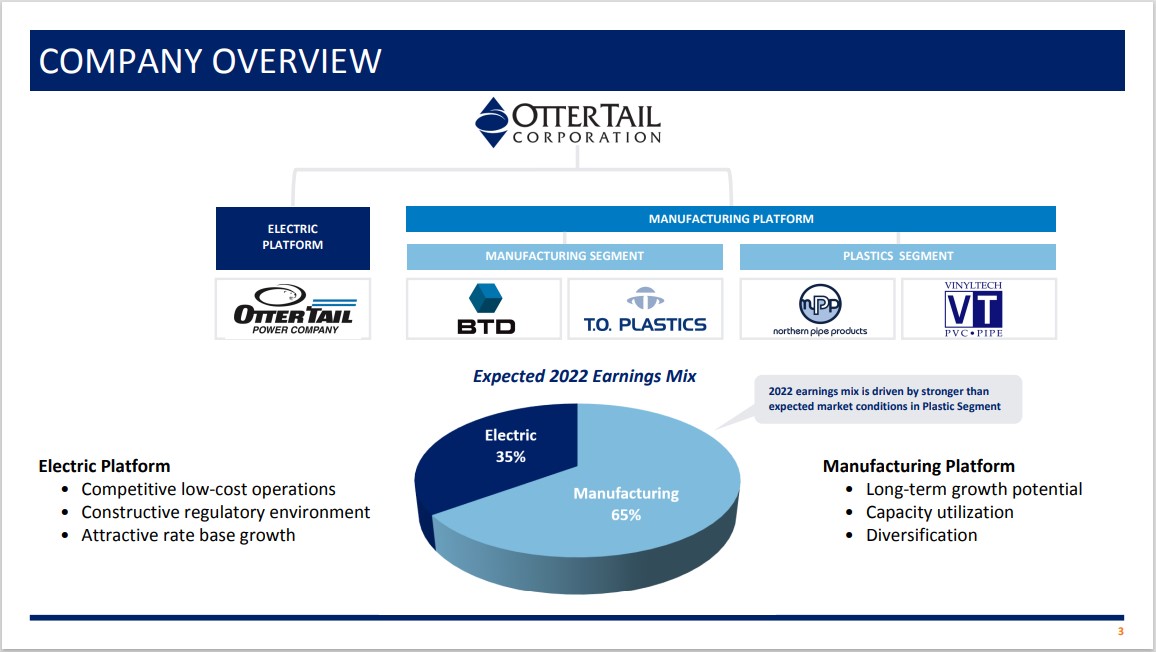

Top Utility Stock #3: Otter Tail Corporation (OTTR)

5-year expected annual returns: 9.9%

Otter Tail Corporation goes back to 1907 with its electric utility, which was founded in Fergus Falls, MN. The company eventually expanded into metal fabrication and plastics manufacturing and today, it has about $1.3 billion in annual revenue split between utility, manufacturing and plastics operations.

Otter Tail’s payout ratio remains around two-thirds of earnings and we don’t expect that will change. The company continues to boost its payout at roughly the same rate as earnings, so the dividend is quite safe and should continue to move higher over time.

Otter Tail’s competitive advantage of having a diversified business model is also its disadvantage during recessions. The non-utility businesses are providing strong growth today but during the last recession, earnings fell much more than expected for a pure utility. That will likely happen next time there is a downturn, so investors should keep this in mind.

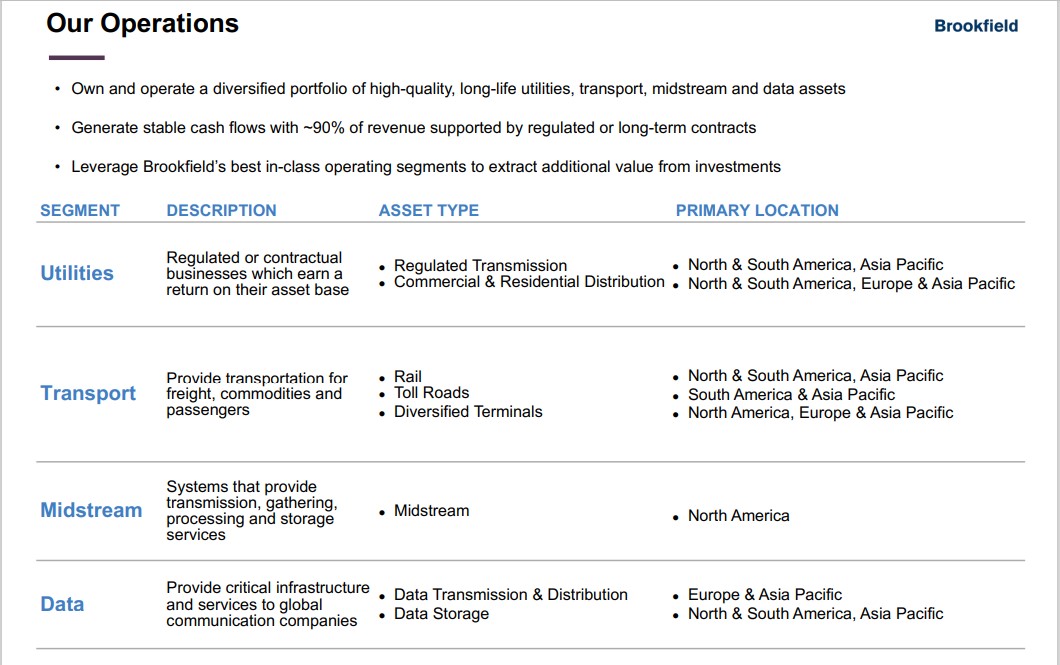

Top Utility Stock #2: Brookfield Infrastructure Partners (BIP)

Brookfield Infrastructure Partners L.P. is one of the largest global owners and operators of infrastructure networks, which includes operations in sectors such as energy, water, freight, passengers, and data. Brookfield Infrastructure Partners is one of four publicly-traded listed partnerships that is operated by Brookfield Asset Management (BAM).

Brookfield Infrastructure Partners is a Bermuda-based limited partnership that is treated as a partnership for U.S. and Canadian tax purposes, and it reports financial results in U.S. dollars. It spun off Brookfield Infrastructure Corp. (BIPC, TSX:BIPC) in early 2020 for investors who prefer to invest in a corporation.

BIP reported stable Q1 2022 results on 05/04/22. For the quarter, its funds-from-operations (FFO) 14% to $493 million. On a per-unit basis, its FFO climbed 3% to $0.96. The FFOPS was much lower due to shares issued for the Inter Pipeline acquisition that was completed on October 28, 2021. Management believes Inter Pipeline will more meaningfully contribute to results down the road.

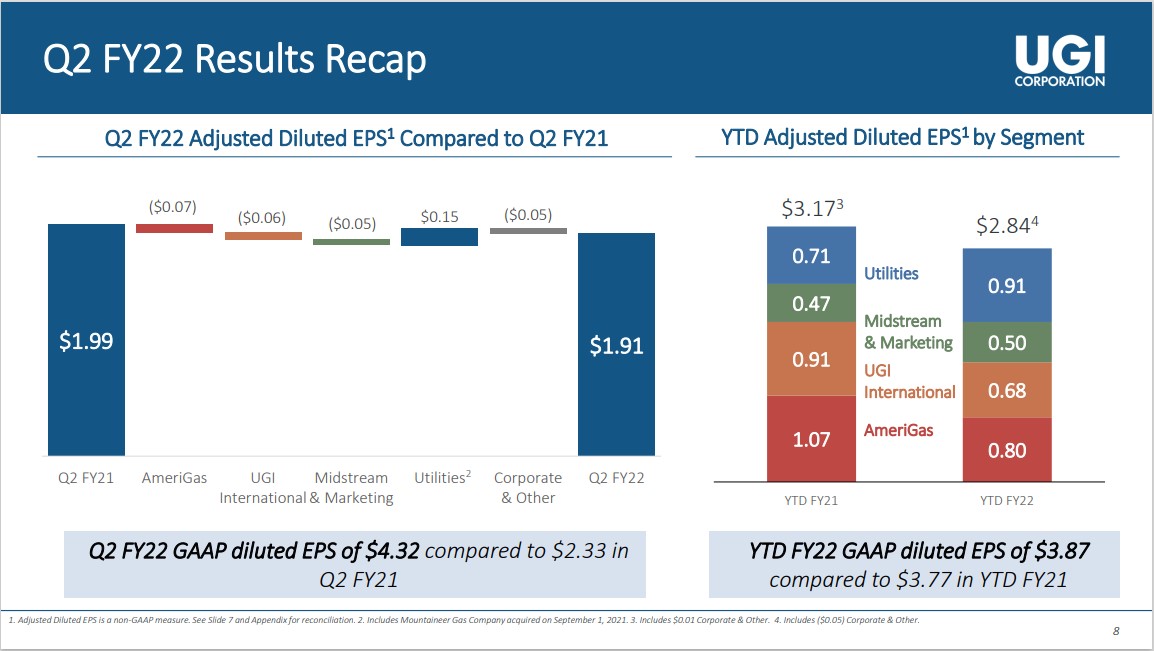

Top Utility Stock #1: UGI Corporation (UGI)

5-year expected annual returns: 10.9%

UGI Corporation is a gas and electric utility that operates in Pennsylvania, in addition to a large energy distribution business that serves the entire US and other parts of the world. It was founded in 1882 and has paid consecutive dividends since 1885. It should generate about $8.2 billion in revenue this year. The company operates in four reporting segments: AmeriGas, UGI International, Midstream & Marketing, and UGI Utilities.

UGI reported FQ2 results on 05/04/22. Adjusted earnings-per-diluted share for the quarter came in at $1.91, down from $1.99 per diluted share in the year-ago quarter.

GAAP diluted EPS came in at $4.32, up from $2.33 in the year-ago period while revenue increased by 34.29% year-over-year to $3.47 billion. Reportable segments earnings before interest expense and income taxes stood at $631 million from $630 million in the year-ago period.

The company also reported available liquidity of ~$1.9 billion as of March 31, 2022. Meanwhile, the management approved a quarterly dividend increase of $0.36 per share on May 4, 2022, making it the 35th consecutive year of annual dividend increases.

Total returns are expected to reach 10.9% per year, due to 8.2% expected EPS growth, the 3.2% dividend yield, and a -0.5% per year negative return from a declining P/E multiple.

Final Thoughts

The utility sector is a great place to find high-quality dividend stocks suitable for long-term investment.

It is not, however, the only place to find attractive investments.

So where should you invest $100 right now?

Our award-winning analyst team just revealed what they believe are the 5 top under-the-radar income stocks for investors to buy right now…