#1 AI stock trading for $3

Sponsored

AI is by far the biggest tech investing trend of 2023.

But Ross Givens says the #1 artificial intelligence stock is NOT Microsoft, Google, Amazon or Apple.

Nope – his research is pointing to a tiny, under-the-radar stock that's trading for just $3 right now…

And could soon shoot to the moon, handing early investors a windfall.

This company already has 98 registered patents for cutting-edge voice and sound recognition technology…

And has lined up major partnerships with Honda, Netflix, Pandora, Mercedes Benz and many, many others.

So if you missed out on Microsoft when it first went public back in 1986…

This could be your shot at redemption.

Click here now for the full details of this $3 stock that's set to rocket in the AI revolution…

There’s no denying that Shopify (SHOP) stock ran too far, too fast in 2020 and 2021. After a sharp-share price decline, Shopify is showing signs of life in 2023. Follow-through isn’t guaranteed, but a small share position in Shopify could yield decent returns.

For years, Shopify made it easy for merchants to sell their products online. However, the company strayed from its core competency for a while.

Fortunately, this year Shopify is steering the ship back on course. The company has an artificial intelligence connection that you might not have expected.

| SHOP | Shopify | $63.79 |

Renewed Focus Should Benefit SHOP Stock

Not long ago, analysts with Jefferies raised their price target on SHOP stock from $44 to $65. That’s a sizable price target hike, but it’s understandable since Shopify shares have quickly gained value this year.

Indeed, Shopify appears to be moving quickly along the comeback trail as its shares, once worth $170 apiece, recently broke above $60. Perhaps, this is happening because investors are glad to see Shopify focusing on what it does best.

Truly, it’s a relief to witness Shopify selling most of its logistics business assets to Flexport. Since Flexport is a global logistics company, it can certainly put those assets to good use. Shopify should benefit from this arrangement as well, as the company “will receive stock representing a 13% equity interest in Flexport, on top of its existing equity interest.”

Going forward, Shopify will be empowered to pursue more value-added e-commerce business interests. For instance, Shopify recently rolled out its Shop Cash rewards program the Shop app.

Shoppers love rewards, so this program could potentially attract new customers while helping to keep existing customers active on the app.

Shopify Leverages AI Technology

Nowadays, tech-market investors want to see companies utilize machine learning. Otherwise, these businesses may fall behind while their competitors effectively deploy generative AI.

This is certainly true in the sphere of e-commerce. You might not be aware of this, but Shopify has proactively enhanced its Shop app with machine learning functionality.

And, we’re not just talking about any AI technology here. Shopify has embedded its Shop app with an “AI-powered shopping assistant” that’s powered by none other than OpenAI, the developer of ChatGPT.

Thus, the Shop app’s “ChatGPT powered assistant is ready to talk products, trends, and maybe even the meaning of life,” according to the Shop app’s official Twitter account.

The AI Shopping Assistant enables merchants to increase the “conversion of your e-commerce by not leaving customers with doubts.”

SHOP Stock’s Turnaround Is in Progress

Shopify shares gained too much value in 2020 and 2021, so a pullback was practically inevitable. Now, Shopify is regaining favor on Wall Street and providing some relief to investors who bought near the top.

Besides, it’s encouraging to know that Shopify’s isn’t ignoring the important generative AI trend in e-commerce. So, SHOP stock earns a solid “B” rating as it’s still a “show-me” story, but at least Shopify is demonstrating focus and initiative in 2023.

On the date of publication, neither Louis Navellier nor the InvestorPlace Research Staff member primarily responsible for this article held (either directly or indirectly) any positions in the securities mentioned in this article.

Louis Navellier, who has been called “one of the most important money managers of our time,” has broken the silence in this shocking “tell all” video… exposing one of the most shocking events in our country’s history… and the one move every American needs to make today.

New incredibly accurate A.I. system predicts Tesla's stock price

Sponsored

Just recently TradeSmith, one of the world's most cutting-edge financial tech companies, rolled out a brand-new A.I. predictive system called An-E which stands for Analytical Engine.

TradeSmith is also giving folks a “sneak peek” of some of An-E's predictions, so you could see what it's capable of for yourself.

Here's one of them…

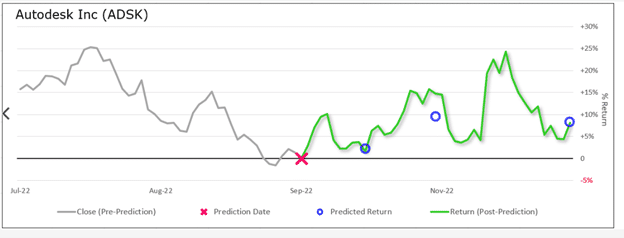

This chart of a company called Autodesk:

Here you can see a red X. That's when An-E made its prediction about where Autodesk's stock price would go…

And those blue circles represent An-E's predictions two weeks, one month, and two months into the future.

Well, here's what actually happened with Autodesk's stock over the next two months…

As you can see, An-E's forecast is almost spot on…

If you would have invested based on its predictions… you would have made nearly 15% in a month.

Here's another one…

This is Carnival, the cruise line company.

Again, we see the blue circles representing An-E's predictions…

And here's how Carnival's stock played out…

And those are just two examples from a test they ran. TradeSmith has dozens more, including a prediction An-E just made about Tesla's stock.

You can get all the details behind An-E, including its latest prediction about Tesla by going here.

I think you'll be surprised by where An-E says Tesla's heading.