Over 97% of Americans do not receive the maximum amount of Social Security benefits allowed by law, according to the Center for Retirement Research.

In many cases, Americans are missing out on over $150,000 in lifetime benefits—an astronomical figure for any social class.

Today, we'd like to show you the one simple way to ensure you receive all of the money you are entitled to.

It's thanks to a little-known law called “H.R. 1,” and it all starts with one word:

Void.

If you are under the age of 70 and plan on filing for Social Security, “voiding” your application is a crucial step in getting every benefit you are entitled to.

The problem is that most Americans think of Social Security as something you simply sign up for when you want to retire after a certain age. The truth is “signing up” for Social Security can be an extremely complex process, and most Americans are missing out on benefits they didn’t know are available to them.

Editor's Note: You can see the full list of Social Security benefits most Americans are missing out on by clicking here.

There are 2,738 grueling sections to the Social Security handbook, which makes it nearly impossible to read and digest. Filled with rules, strategies, caveats and restrictions, it’s no wonder even informed Americans still make the wrong filing decisions.

Fortunately, the best way to maximize your benefits is based on one simple factor…

Your Age Is the Key

The age at which you decide to file for Social Security is one of the most crucial decisions you can make for your retirement income. In order to claim your full, regular Social Security benefits, you must be 66 years old. This is called “full retirement age.” If you aren’t aware, your benefits can either increase or decrease based on your age.

You can claim your benefits as early as 62 years old or at any age after. However, for each year you claim early (before 66 years of age), there is a percentage deducted from your monthly payment, reducing your total benefits.

For example, if your full retirement benefits would be $1,000 a month at 66 years of age and you claimed early at 62, you would receive $750 a month instead of the full payment. This penalty may not seem like much, but it makes a big difference for your total lifetime benefits.

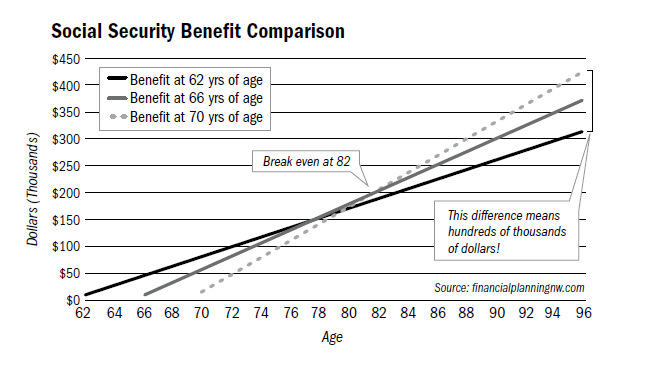

On the other hand, for every year you wait after full retirement age, your benefits grow by 8% a year, up until the age of 70. Now, 8% might not seem like much growth, but if you look at the chart below, you will see how significantly your benefits can rise if you wait. Each line represents how much money you would receive based on the age at which you file.

You can see from the graph that if you expect to live 82 years, filing at 70 can significantly raise your lifetime benefits. Over the course of your life, it can add up to hundreds of thousands of dollars in extra income.

From our example before, it’s the difference between $750 a month at 62 or $1,320 at 70. That’s an extra $570 a month!

Editor's Note: $570 a month is just a small percent of the overall savings Zach Scheidt has found for seniors. Check this out…

The simple lesson is that the later you file, the greater your benefits. If you don’t mind holding off on taking your Social Security checks, then I recommend waiting in order to maximize the amount you can receive from the government. However, everyone’s situation is different, and filing at an earlier time might be best depending on the circumstances.

Filing early is a good strategy if you are in desperate need of income or in a situation that reduces your life expectancy. Maybe you just are unsure of the future and feel better taking the money while it is offered. However, if you can, delaying your payments until you are 70 is by far the most efficient way to maximize your lifetime benefits.

After you are 70, your benefits cannot grow any further. Therefore, 70 should be the latest age at which you file. Any later date is a waste, because your payments can no longer grow.

If you file when you are 70, by the time you reach 82 years of age, you will have already made up the income you would have received by delaying payments. After that, the extra income keeps adding up. If you are healthy and expect to live past 82, it makes no sense to claim benefits early when the value added from waiting is so high. In fact, by delaying payments, you can increase your benefits by 76%.

Bottom Line: Take note of this strategy and discuss the benefits with your financial adviser. This is one of the easiest ways to increase your lifetime benefits by over $100,000.

Zach’s Income Rating:

Excerpted with permission from Zach Scheidt's “Big Book of Income” (Chapter 28).