Short sellers profiting from the savage sell-off in silver futures could be in for a torrid time if silver returns to trading in line with gold, and the pair head north.

Silver suffered a brutal sell-off from mid-April to mid-May, triggered by short sellers and rumours that struggling commodity house Nobel Group had been selling its silver holdings in a bid to raise cash.

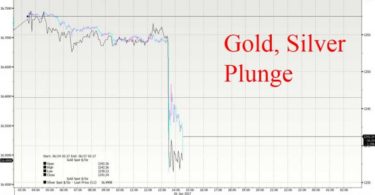

Throughout March, gold and silver traded higher in tandem, as both commodity prices generally do, while investors digested a slew of global geopolitical risks and emphasised the safe-haven trade.

But as appetite for gold waned in subsequent weeks, the collapse in the silver price was particularly dramatic.

In mid-April, silver's gain for the year to date had been 1.36 times that of gold. But as gold fell 5.1 per cent into mid-May, silver experienced a sharp 12.6 per cent drop.

Rumours that Nobel Group was unloading its silver positions and the particular way that short sellers are leveraged meant the tiny, illiquid market was brutalised by the sell-off.

Silver decoupled from gold

This resulted in silver decoupling from gold's path; while bullion remained reasonably well supported, silver plummeted to its lowest point this year.

“At the moment, silver doesn't seem to be seen as a proxy for certainty at all, not in the way that gold does,” says Karl Siegling, portfolio manager at Cadance Capital.

But should the silver price head north, traders might experience a protracted, short squeeze.

Full story at Sydney Morning Herald