Sponsored by TradeSmith

Why this new A.I. could be “ChatGPT for investments”

Sponsored

If you've turned on the news lately, you've undoubtedly heard the world is now being swept by an Artificial Intelligence or A.I. Revolution… I'm sure you know what I'm talking about…

News stories are coming out left and right about how A.I. is going to change everything from how we learn to how we work to how we communicate to how we shop…

And the spark that launched this revolution was last December's release of the breakthrough A.I. language processing program known as ChatGPT.

What made ChatGPT so amazing was you could ask it a complex question and it could give you an answer in a matter of seconds.

It could also perform other complex tasks involving language… for example, if you asked it to… it could write a poem in the style of Walt Whitman or describe Newton's laws of motion.

Well, imagine if you had a similar kind of program… only for the stock market.

Imagine you could ask an A.I. program what price Google stock is going to be next month…

Or how much the price of gold is going up or down…

And what if it could predict those outcomes with astonishing accuracy?

Well, believe it or not, one of the world's leading financial tech companies, a company called TradeSmith, launched a program recently that does exactly what I just described…

It's an A.I.-driven market forecasting system called An-E (pronounced Annie, short for Analytical Engine).

An-E can predict the price of nearly 3,000 stocks one month into the future, and it's often spot on or only a percentage or two off.

To get the full details behind An-E and how it can help you target winner after winner and avoid the losers, click here.

When it comes to your money, artificial intelligence (AI) can pack a punch in two ways.

You can invest “in” AI — finding companies that are winning the “dash for cash” because they built their businesses around the revolutionary technology.

And you can invest “with” AI — using that tech to find the “right stocks” at the right price at the exact right time.

And thanks to our own AI-enhanced analytics, TradeSmith is one of the few companies that can help you do both.

And we’re going to help you do both here today.

With a stock.

And with a strategy.

Investing In AI Stocks

Let’s start with the stock.

A company called Palantir Technologies Inc. (PLTR).

Palantir is a Big Data analytics company. And its corporate tagline “AI-powered operations, for every decision” — says it all.

For example, Palantir’s technology was deployed at the Agua Nueva Water Reclamation Site in Arizona to provide better insight into the plant’s operations. Situated in the Sonoran Desert — one of the hottest deserts in North America — the plant literally delivers “new water” (Agua Nueva) to that arid community.

And Palantir delivered, including:

- A 20% increase in power savings.

- A drop in operational fines.

- And a hefty reduction in greenhouse gas emissions.

Palantir is also known for its strong rapport with the United States military, policymaking, and intelligence agencies.

And on Monday, Palantir’s shares jumped more than 4% after a price target upgrade from BofA Securities analyst Mariana Perez Mora.

In her research note to clients, Perez Mora characterized Palantir as a “pick-and-shovel” player in the AI arena.

“Most of the corporations eager to use generative AI have compliance, regulatory, ethical, legal, privacy rights, data security, and accountability/oversight requirements,” Perez Mora wrote. “From its experience working with the government and highly regulated industries, [Palantir] has already developed and implemented the architectural design that supports generative AI in a compliant and private world.”

She upgraded her price target from $13 to $18 for PLTR.

The stock is trading above $16 this week — meaning there’s 12% in upside if it hits her target.

And, with a longer-term outlook — as a company that’s already monetizing AI — there could be bigger gains.

But, before racing out to buy Palantir, remember that I said successful investing means you need to invest with AI to find the best ways to invest in AI — and to dodge mistakes.

We can do that with our intelligent-investing system — an algorithm we’ve nicknamed An-E.

Palantir Meets An-E

Imagine two scenarios.

In the first, you look at a stock and know, with a high degree of certainty, that it’ll be 15% higher a month from now.

In the second, you look at a different stock and know that it’s going to take a 15% haircut sometime in the next month.

You’d buy the first stock, knowing a profit is headed your way.

And you’d avoid the second, feeling sanguine having evaded a painful-and-costly loss.

Imagine no longer.

Both those opportunities are here.

Now.

With incredible computing power and AI at our fingertips, the TradeSmith team embarked on the most important research project in our company’s history… one designed to ramp up your gains on stocks — while slashing the potential for risk and mistakes.

We call this incredible system An-E.

And running Palantir through An-E, we came away with a fascinating discovery.

While Wall Street is impressed with Palantir, An-E is not.

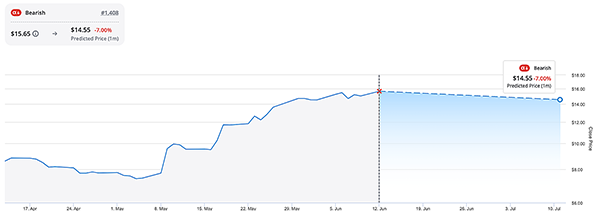

At least, not over the next month — where our tools don’t see the upside:

PLTR may be on a run that sent the stock price too high and too fast, as An-E sees the stock trading at $14.55 by July 11.

Instead of the 12% upside we talked about earlier, An-E sees a 7% drop (from the time it made its prediction at $15.65 per share).

I grant you, Palantir could be a good investment for someone with a long-term outlook.

But long-term time frames also connote uncertainty. That’s the power we bring. With a short-term outlook, this can be a signal that now is not the time to invest in Palantir and can help save you from making an emotionally based investing decision.

The classic trap most retail investors fall into is buying high and selling low after they see something like Palantir climb over 4% in a day and “chase” a stock because they fear missing out on further gains.

Then, the stock has a bit of a pullback and retail investors panic sell and lose money.

With An-E, you’re able to see these projected pullbacks and wait for a potentially more opportune time to invest.

See An-E's stock price predictions of TSLA, NVDA, and AAPL

Sponsored

One of the world's top financial tech companies recently launched a breakthrough, new A.I. stock predictive system called An-E (pronounced Annie, short for Analytical Engine).

They tested it by tasking it with many thousands of stock predictions… and comparing its forecasts with what actually happened.

And many of those predictions ended up being incredibly accurate, often times either spot on or only a percentage or two off.

That was one of the main reasons TradeSmith knew they could bring An-E to the market, and show its capabilities to the public…

Which we did recently by putting on a special presentation.

During that event, TradeSmith had An-E “take aim” at some of the biggest, most popular stocks on the market… Tesla (TSLA), Nvidia (NVDA), and Apple (AAPL)…

And predict their stock prices one month into the future.

Well, where did An-E think they would end up?

The answer was pretty shocking.