Expert Who Predicted Black Monday and Dotcom Crash Issues New Warning

Sponsored

Do you believe America's economic fallout from 2020 has been fixed? Do you think things could get worse? If you are concerned about these possibilities, you are not alone. Expert who predicted Black Monday and Dotcom crash issues new important message.

If you have to boil down 2023 into a single theme, it would have to be artificial intelligence. Even though AI in various forms has been around for a while, it’s the emergence of generative AI and ChatGPT that has turned enthusiasm into outright mania.

That’s also instigated a furious mega-cap tech stock rally that’s really disconnected from the rest of the market. While the equal-weight S&P 500 index, a benchmark I’ve been using lately as a measuring stick for the broader equity market, is up around 15% on the year, the Nasdaq-100 is up 40%. Almost all the index’s gains have been driven by just seven stocks, including Nvidia (NVDA), which was really the company that stoked the fire in the past month.

While that’s been great for investors who managed to capture these gains, it creates a dangerously imbalanced market. Investors are buying into the idea that we’re in a new bull market because the S&P 500 is up 20% from its low. In reality, conditions are much weaker than the major averages would have you believe. Investors who don’t realize this are setting themselves up for a potential disaster in their portfolios.

Don’t Let the Nasdaq-100 Rally Fool You

Let’s consider that 40% return in the Nasdaq-100. With a return like that, we should expect to see more winners than losers, right? Nope.

The Nasdaq advance/decline line is virtually unchanged from the beginning of the year! In January, market breadth was much stronger when several key metrics indicated that the economy was stronger and more resilient than originally thought. In late May when “AI mania” took over? It was higher, but not by much. This chart is a perfect example of why a half dozen stocks aren’t “the market.”

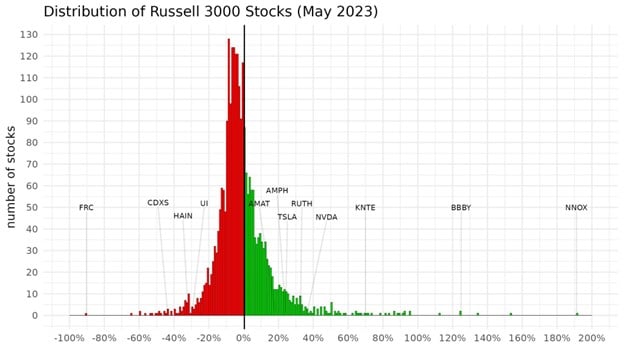

Here’s another good example. About two months ago, I said that conditions favored a traditional market correction beginning in late April that could carry forward well into May. During the full month of May, the Nasdaq-100 was up nearly 8%, making it easy to conclude that the correction didn’t happen. More broadly, the Russell 3000 was up a mere 1%, a return far lower but still positive, so no correction, right? Well, not so much.

Source: Chart courtesy of Michael A. Gayed

Over half of Russell 3000 components were down in May. The largest cohort was in the 0%-10% return range, but there were easily over another hundred that were down more than 20%. That’s the influence of a handful of mega-cap stocks in a capitalization-weighted index. They can overshadow a lot of weakness hiding beneath the surface.

But the S&P 500 is more than 20% above its low. If that definition does indeed qualify as the beginning of a new bull market, how does this rally stand up against history?

NVDA Stock May Be a Trap Here

Here’s the general rule of market rallies that occur off a bear market bottom — they’re quick and they’re sharp. The 2022-23 rally is neither. It’s taken roughly eight months for the S&P 500 to claw that first 20% back, which would easily be the longest it’s taken to reach that mark in nearly a century. If we isolate just the first eight months of new bull market rallies, the 20% gain of this one would be the second smallest on record.

This rally has been slow and shallow, characteristics which, historically, have rarely marked a true market bottom. With the global economy still deteriorating as we speak, it seems unlikely that the real bottom is in yet.

If you want to buy NVDA stock at more than 200 times earnings, have at it. If you want to buy the tech sector at more than 28 times forward earnings heading into an economic slowdown, be my guest. The market signals suggest that there’s potentially more downside to come before this is all over. The Nvidia-inspired tech rally may find a lot of unfortunate investors way too far out over their skis.

Profit from Dollar Replacement Panic?

Sponsored

Thanks to President Biden's Executive Order 14067…

…I predict the 3rd Great Dollar Earthquake has started.

These currency upheavals happen about every 40 years.

The first was Roosevelt confiscating private gold in 1934…

The second was Nixon abandoning the gold standard in 1971…

Now, Biden's plan could pave the way for “retiring” the US dollar…

And replacing it with THIS.

Amid the turmoil, there will be many losers.