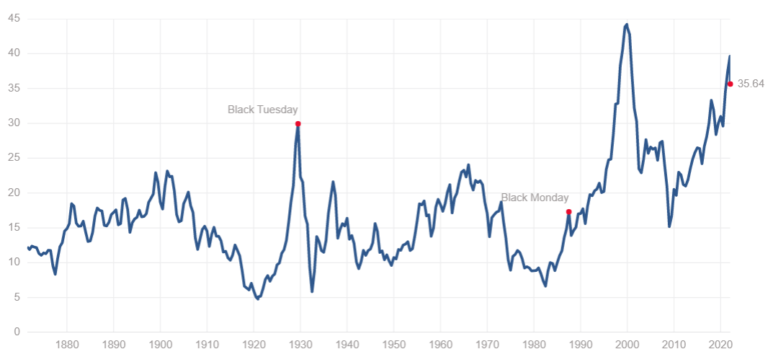

The market is overvalued from a historical perspective. The image below shows the Shiller PE Ratio over time for the S&P 500.

The Dot Com Bubble

Only the tech boom of the late 90’s and early 2000’s saw a higher Shiller PE Ratio. That market rally ended in a steep crash of ~50% for the S&P 500. But not all stocks fared the same. Stocks that were most supported by the bubble fell the hardest.

When valuation multiples are too high relative to what growth turns out to be, a stock can be a poor investment even though the underlying business continues growing.

“For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments.

– Warren Buffett

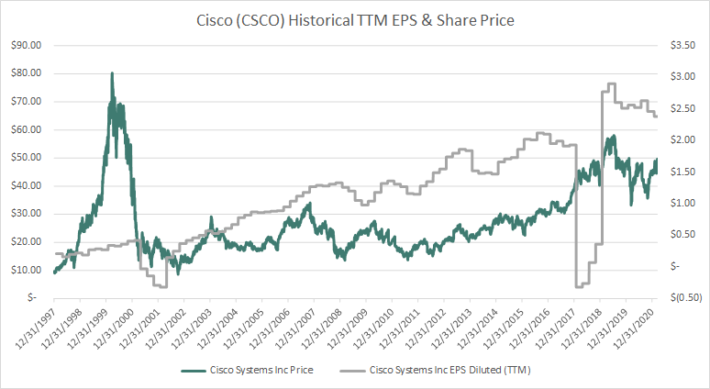

Shares of Cisco (CSCO), Oracle (ORCL), and Amazon (AMZN) all fell by more than 80% from previous highs… And these are not the companies that ended up failing completely. Cisco in particular is a good example of an excellent company that traded for far too high of a price in the tech bubble.

Cisco as a business has done well and increased shareholder value on a per share basis over time. However, the stock was swept up in the tech bubble of ~20 years ago. And the company’s stock still has not reached its previous highs, despite strong earnings-per-share growth.Source: Data from Ycharts.

Meanwhile, many blue-chip non-tech companies saw much lower drawdowns during the Dot Com Bubble. Johnson & Johnson (JNJ), 3M (MMM), and Colgate-Palmolive (CL) all saw drawdowns under 40% as examples.

A Market Of Individual Stocks

The stock market is made up of individual securities. Securities that are undervalued now are less likely to see as steep of drawdowns in a valuation-based market sell off. We expect companies with the most inflated valuations to fall the farthest.

Despite the market’s high valuation level as a whole, there are many individual securities still trading at bargain prices.

When good values are available, we advise investing, regardless of overall market levels. We know the market is overvalued, but we don’t know when market valuations will fall. It could be next week, or 3 years from now. Waiting to invest means missing out on compelling investments available now.

Final Thoughts

So, where should you invest $100 right now?

Our award-winning analyst team just revealed what they believe are the 5 top under-the-radar income stocks for investors to buy right now…