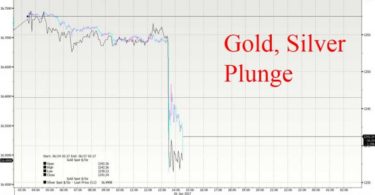

Investors are fleeing to gold in a desperate attempt to weather the recent market volatility… but is this long time “safe-haven” actually poised to collapse wiping out trillions of dollars of wealth in the process?

Photo: Dent Research

One highly respected Harvard economist is stating an emphatic “yes!”

“While many economists will argue that gold is not in a bubble… and insist it will soar to $2,000, $5,000 and even $10,000, my research has said otherwise” says Harvard economist Harry Dent in his latest report. “I’ve never been more certain of anything in over 30 years of economic forecasting.”

Market volatility, worries over the Europe Central Bank, negative interest rates, and China are among a laundry list of events that are driving panicked masses to buy the yellow metal. But this is only inflating the gold bubble that is poised to pop at any moment, he says.

Dent, who pioneered a whole new science of economic forecasting in the early 1980’s has been able to accurately predict almost every major economic event over the past 30 years. —including the collapse of Japan, The Great Tech Boom of the 1990’s, and the 2008 market crash.

Now his latest prediction his proving controversial among financial circles across the country.

Traditionally investors flock to gold as a way to hedge against inflation. But according to Dent’s research, we’re about to see the exact opposite happen.

Dent warns that we are about to experience an economic crisis far worse than 2008 — the full-blown collapse of the stock market and massive deflation.

And that investors who attempt to hide their money in the “safe haven” of gold, could damage their wealth to an even greater degree.

Full story at Dent Research