Dear Investors,

I had just finished writing our monthly newsletter when the US trade war with China heated up again. I decided to quickly write another letter, this time focusing on tariffs.

Basically everything you’ve read about who pays tariffs is simultaneous right and wrong. It seems that everyone writing about them has an ulterior motive. The Trump administration is relentless in claiming China pays for tariffs while the business community is emphatic that it’s consumers bearing the full brunt.

In reality, there are basically four different scenarios (not counting foreign currency exchange rate fluctuations) on who pays tariffs. The following are slides taken from the annual presentation I give to my business clients.

The first situation is the most benign. Companies can just change suppliers and life goes on. Right now this situation is probably the rarest as it’s difficult for businesses, especially in manufacturing, to change their supply chain in a matter of weeks or months.

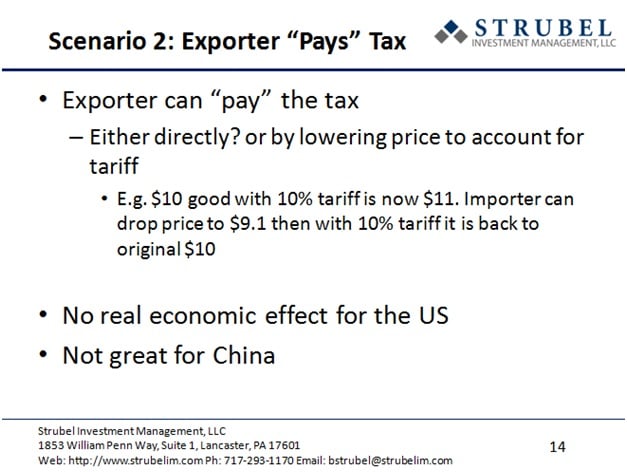

In this scenario the exporter either pays indirectly by lowering their prices so that with the tariff added the good is the same price as before. Although I’m fuzzy on the legal details, it may be possible for a US based but Chinese owned importer to pay the tariff tax directly if they import the product. Even if this is not the case, they can accomplish the same thing by simply lowering the price. The economic results are roughly the same so for investors purposes the legal details are immaterial.

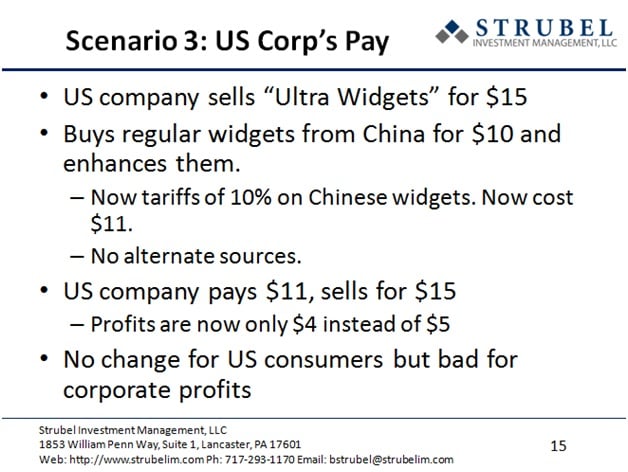

In this scenario, businesses are forced to eat the extra costs. This scenario tends to happen in fragmented, competitive industries.

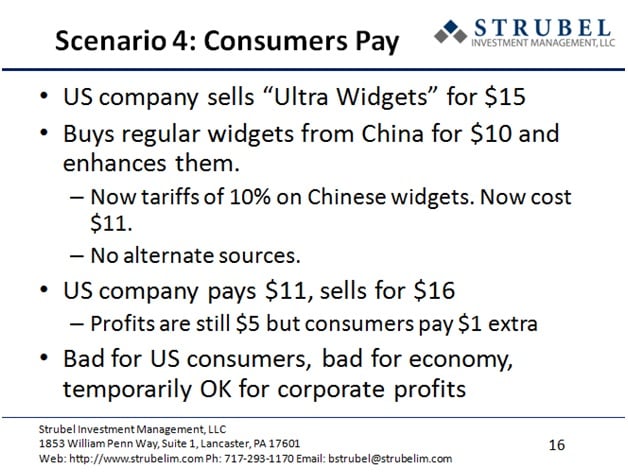

In the final scenario it’s consumer that pay the costs of the tariffs. This scenario tends to happen in more consolidated industries with less competition, which makes it easier for businesses to raise prices.