Why Wall Street is betting $250 billion on this story

Sponsored

The biggest firms on Wall Street are betting $250 billion on Elon Musk right now. And I'm convinced it's not just because of self-driving cars… …But because of this explosive market that's 1,000X BIGGER. Billionaire VC Chamath Palihapitiya agrees, saying… “This is no longer about cars… [This] is worth trillions of dollars.” It's why I'm convinced this story could easily be the #1 trade idea for 2023. (And I'm not just talking about $TSLA.) If I'm right, we could see 10X potential upside… or more. Click here to get the details now before it's too late.

What is going on investors? I hope you guys are doing well out there.

On today’s show, we’ve got to have a serious discussion. We’ve got to talk about all the fake artificial intelligence (“AI”) companies that will be reporting their earnings over the next couple of weeks.

They’ll get out in front of investors and analysts… and have conference calls and press releases… where the executives say “AI” as many times as they possibly can. And they’ll try to fool investors like yourself.

You may hear their fancy words and dialogue and presume that the company – with its big name, big market cap, and maybe a big share price – and assume that, “Boy, they must have some big AI plans.”

But the bottom line is that there will be some real fake AI companies reporting. And probably the biggest and fakest AI company to report came from none other than Intel (INTC).

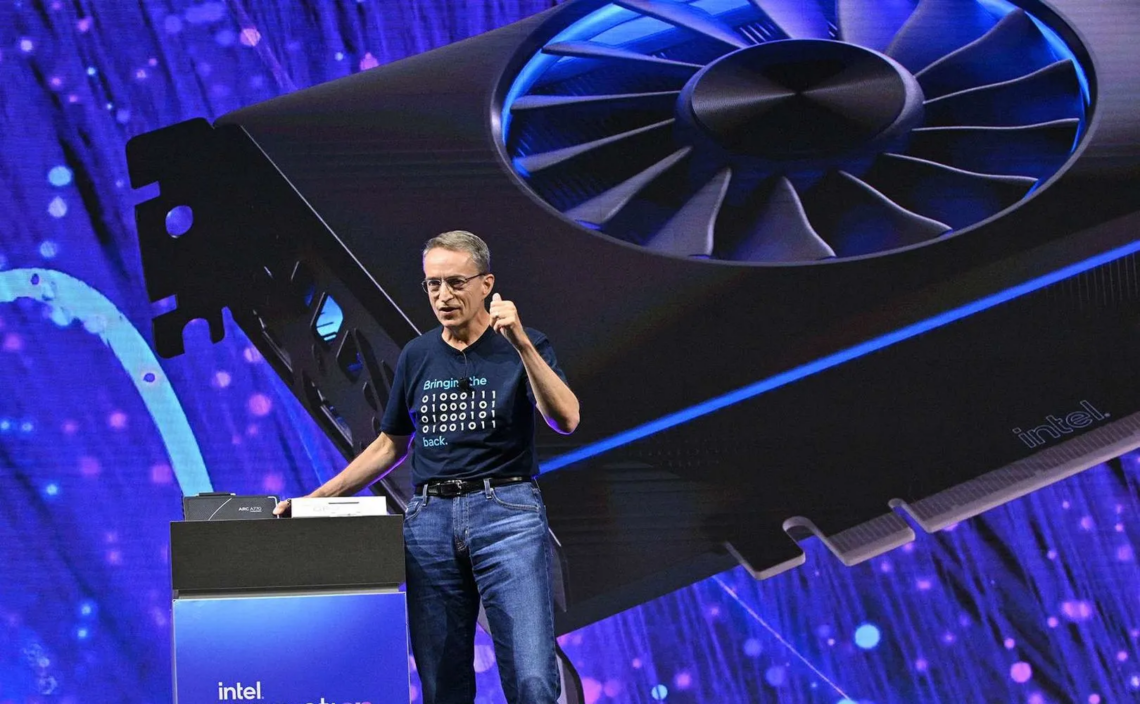

This company is the fakest AI company on the planet. And how do we know that? Because despite Intel CEO Pat Gelsinger getting on the conference call and saying AI more than 30 times, the numbers don’t lie.

As we’ve looked over the past year, what’s happened to the semiconductor industry – particularly the ones that are leading the way… I mean, look at Nvidia. Nvidia has posted blowout numbers every single quarter for the last four quarters.

They’ve beaten and raised by multiples in the stock market that we haven’t seen in years and years. They’ve had unbelievable quarterly results as it relates to revenue growth and forward guidance.

And that’s because Nvidia actually makes a real AI product that’s in demand.

We can also look at second place, if you will, in the semiconductor industry – Advanced Micro Devices (AMD).

Subscribers to the channel and the newsletter will know AMD quite well. We recommended AMD shares back in July when it traded at about $115 per share.

It’s been moving more or less in a straight line up ever since. AMD is up more than 54% since we made the recommendation. The company has a viable alternative to Nvidia’s products in the AI marketplace.

On top of that, AMD has a diversified portfolio for the server market, gaming market, and PC market. And as Intel results will show you, it’s absolutely crushing and eating Intel’s lunch.

And somehow, Intel – while first-runner-up AMD is outperforming them across the gaming, PC, and data center industries – is somehow going to convince you they’re going to compete against TSMC? The largest chip manufacturing foundry company in the world?

Somehow, says Intel, it’s going to compete in the semiconductor industry starting in the year 2030.

I’m here to tell you that none of that will be true. The numbers don’t support that. As Intel reported their Q4 numbers, they also gave us first-quarter guidance. Those revenues are expected to clock from $12.2 billion up to $13.2 billion.

The problem with that, folks, is while $12 and $13 billion is a lot of money, Wall Street was expecting a number closer to $14.2 billion.

Also complicating the situation is that Intel just put up a quarter where they did $15.4 billion worth of revenue. So, unlike Nvidia and AMD, Intel’s revenues are falling off a cliff. And that tells me that any AI product they have that should be flying off the shelf, certainly isn’t.

What’s more is when you dig into the numbers over at Intel, the company had $54.2 billion worth of revenue over the past 12 months at the chipmaker. Revenue in 2022, by comparison, was closer to $63 billion.

Even more unfortunate than that is that after you factor in the cost to make the chips plus research and development in sales and marketing… Intel managed to squeak out just $93 million worth of profit.

Now, $93 million is quite a bit of money. But when the company is worth more than $200 billion and trades at 51 times earnings, $93 million for a full year’s operating profits isn’t going to light the world on fire.

And it’s not going to get investors very excited, and neither will the fact that over the past 12 months, Intel saw $11.5 billion in operating cash flow. Operating cash flow is the actual cash profits that flow into Intel.

It doesn’t take into account things like stock-based compensation, which is non-cash. Also, things like depreciation, which again, is more or less an accounting charge.

Now, the problem with $11.5 billion worth of operating cash flow for Intel over the last year is the fact that the company paid out $3.1 billion worth of cash dividends to shareholders.

So, minus dividends, you’re producing less than $9 billion in operating cash flow. Now, the big problem is that Intel is trying to convince investors that it’s going to become a foundry.

A foundry is what TSM is to the chip world. TSM manufactures all of the chips for Apple, Nvidia, and AMD. Actually, even Intel manufactures a lot of their chips at the TSM foundry in Taiwan.

Intel is trying to convince not only the U.S. government but investors as well that it’s going to somehow infringe on that space… And that it will be able to invest tens of billions of dollars over the next couple of years to be able to even start that business up, let alone compete.

Unfortunately for shareholders, Intel spent $25.8 billion on property plants and equipment over the past 12 months.

And $25 billion is obviously well over the $11.5 billion worth of operating cash flows before they had to pay a dividend. It also represents about half of the company’s revenue.

That also makes the Q1 guide between 12.2 billion and $13.2 billion worth of revenue even more worrisome, as last time I checked those foundries aren’t even built yet. So I would expect a hefty amount of property plant and equipment spent for Intel over the next 12 months.

Now, how is the company going to pay for it?

If you guessed, “by issuing long-term debt,” you’d be correct. Over the past 12 months, the company issued $11.4 billion worth of long-term debt, which was about as much as operating cash flow as the company produced.

Considering interest rates are no longer zero or damn near negative for these corporations, I guarantee you that Intel borrowing that $11.4 billion comes at a rather hefty interest rate.

Folks, there will be a lot of fake AI companies that report their earnings. On the software side, you actually can get away with it, to an extent. The recurring revenues of software and the natural likelihood that many businesses simply renew their software every year can create rather steady revenues for software companies. That gives them time to create AI products that could potentially rival the likes of Microsoft, Salesforce, and ServiceNow.

But that’s not the case in the semiconductor industry.

That’s not possible when you have competitors like Nvidia, AMD, and TSMC, and they’re all so far out in front of Intel.

The fact that this company can, with a straight face, tell investors and the investing community that it’s an AI company is an absolute disgrace. I would avoid companies like Intel at all costs, despite the fact that the shares have performed relatively well over the last year.

Compare even that to the broader semiconductor industry – certainly compare it to AMD and Nvidia – and you’ll see it’s just playing catch-up. And catch-up is what Intel will be trying to do for the next couple of years.

Is THIS why Elon Musk left ChatGPT? (100X BETTER!)

Sponsored

Hey, it's Colin… Elon Musk co-founded OpenAI, the company behind ChatGPT. Musk later left OpenAI… and created his own independent AI startup. And Elon's AI promises to be 100 times stronger than ChatGPT. Because ChatGPT only works online. While Elon's AI works in the real world. You can see and touch Elon's AI: see the real-life demonstration here. Since ChatGPT has already grown 42 times faster than the internet… The sky's the limit for Elon's AI. Here's the key fact: with Elon's three earlier startups… PayPal… SpaceX…and Tesla… You could've turned $300 into $647,000. Can Elon do it again with his AI startup? See for yourself right here in a shocking 2-minute live demonstration of Elon Musk's AI. Click here to watch the demo