This story was originally published here.

Before you branch out and invest in individual stocks or other investments, make sure to ground your portfolio with a dependable base of core investments. It is important that your portfolio’s foundation has a good allocation of stocks and fixed income to weather turbulent economic conditions and markets. This is where a collection of index funds can easily provide that foundation for beginner — and even experienced — investors.

Now, my specialties involve economic and market data as well as developments, and in turn, the best individual securities from stock, bond and other markets to capitalize on those developments for safer growth and income. This is what I showcase in my Profitable Investing now well into its 31st year of publication.

But, having a solid foundation of funds is important. That’s why I recommend index funds in my allocation for stocks and fixed income And I also have a collection of model mutual fund portfolios, including specific portfolios for funds of individual families like Fidelity and Vanguard. I do this to guide subscribers who want or need to stay within fund families.

Let me now show you how I line up the index funds from Fidelity for a well-grounded portfolio foundation.

Stocks, Fixed Income and Cash

To start, I currently allocate 56% of my portfolio to stocks and 44% to fixed-income investments. In that 44% I include 11% in cash. This allocation is different than the 60%/40% balance typical of asset allocations for many managers. But, I have been a bit more conservative ahead of the current lockdown and novel coronavirus challenges.

Let me start with stock allocations. I continue to believe that the U.S. remains the prime market of the globe. The U.S. has been hit hard by lockdowns, but unlike the rest of the major markets, the U.S. has the Federal Reserve. The Fed has been throwing trillions into the economy and markets. Plus, President Donald Trump’s administration got Congress to add trillions more to aid the economy.

So, my allocation is focused on the U.S. right now. This is different from my decades of global focus while I was in banking and asset management.

Here are my top seven index funds from Fidelity for a solid portfolio foundation:

Index Funds: Fidelity High Dividend ETF (FDVV)

Source: Chart from Bloomberg

Source: Chart from Bloomberg

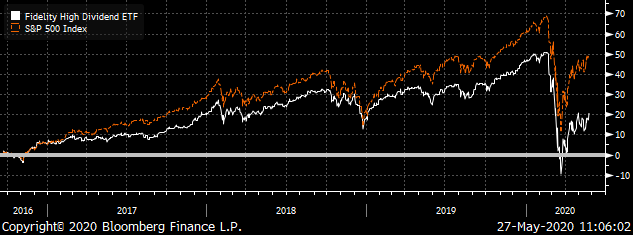

FDVV and S&P 500 Total Return

The starting point for core U.S. stocks with Fidelity is the Fidelity High Dividend ETF. This is an indexed exchange-traded fund that is supposed to track Fidelity’s Core Dividend Index. This index focuses on U.S.-listed stocks which pay higher average dividends.

This is my more measured approach to the S&P 500 as the higher weightings on dividends makes the fund less vulnerable to downturns and volatility.

The ETF is newer to the market as it debuted in September 2016. And since then — particularly during 2019 — the more tech-heavy S&P 500 outpaced the more dividend-focused ETF. But my view is that I want to achieve a lower volatility and lower risk return over time, and not to have a base which is too heavy on a particular sector.

And that makes the Fidelity High Dividend ETF a good start to building a grounded portfolio.

Editor's Note: Click here to see the other six funds.

65 Unique Ways ANYONE Can Make Extra Cash (Without Getting a Second Job)

Are you looking for great sources of real income, without having to get a second job?

Then keep reading, because author Neil George wants to send you his new book that profiles 65 simple ways to earn large amounts of work-free income.

…extra cash that you can collect ON TOP of your Social Security check…

…without messing around with crappy jobs. (Pizza delivery driver? No way.)

These are PROVEN cash-gushing strategies… the kind typically used by the wealthy elite.

And the best part…

Neil George has set aside copies of his book, Income for Life, and he’s willing to send you a hardback version today, ABSOLUTELY FREE (just pay shipping).

(Just 517 copies left, so click here to claim yours before it's ripped away.)

Here's just a sample of what you can find inside:

- Learn the secret of the $50,000 lump sum Social Security check. Seriously, it couldn’t be easier!

- Use what Neil calls the “F.H.A. Loophole” to get the government to pay your mortgage – PLUS receive hundreds in extra cash on top.(Page 217)

- Collect $100s for pictures in Old Family Photo Albums! Believe it or not, there is an easy way to turn your old artwork/photographs into $100 bills (certain businesses are desperate). (Page 297)

- Get paid every time your favorite song gets played on the radio! This little-known website allows you to tap into royalty payments every time your favorite song is played on the radio. Some lucky folks collect thousands of dollars a year! (Page 307)

- Pocket upwards of $197 PER HOUR simply by taking a walk through the woods in the fall… or $137 while visiting your favorite beach in the summer… and many, many more!

Needless to say, this book has become highly sought after.

So if you don't claim your free copy of Income for Life today, we'll send it to the person behind you in line…