This story was originally published here.

With stocks such as Nio (NYSE:NIO) and Tesla (NASDAQ:TSLA) in the midst of seemingly undaunted ascents, electric vehicle ETFs are among the examples of thematic exchange traded funds stepping into the spotlight.

For many investors, particularly those priced out of Tesla or those new to this space, electric vehicle ETFs make a lot of sense. The funds remove the need for investors to identify the best individual names, over diversity and many lack significant exposure to some of the more challenged EV stocks.

Additionally, these thematic ETFs make for ideal plays on the Biden Administration’s renewable energy priorities, including the president-elect’s goal of building 550,000 EV charging stations over the next decade, which would reduce concerns about time in between charges, likely boosting EV demand in the process.

The new president probably won’t be able to put an EV in every driveway, at least not anytime soon, but this administration and Congress are viewed as hospitable to the auto industries electric evolution and that could benefit the following electric vehicle ETFs… Story continues here.

Sponsored:

Electric cars are taking over

Dear Reader,

A new type of battery is pushing everything we thought we knew about energy storage to the limits.

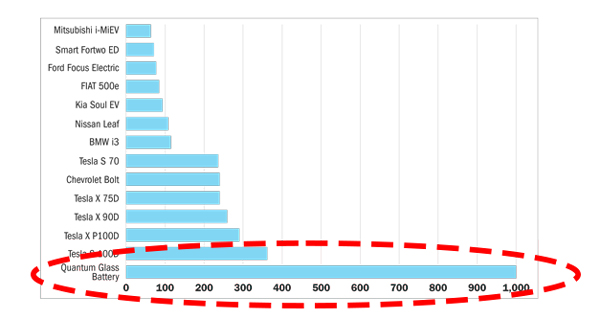

According to automotive insiders, consumers will soon be able to go 1,000 miles on a single charge.

Think about that for a moment…

That’s nearly TRIPLE the distance of the best-performing electric cars on the market right now — and more than 8 TIMES farther than the average electric car…

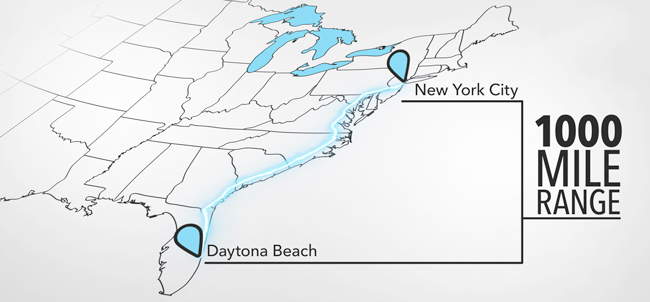

That means you could drive from New York City all the way down to Daytona Beach, Florida, without stopping!

A 1,000-mile range clobbers even the most fuel-efficient gas vehicles on the road today!

In short, this tech is about to change EVERYTHING.

When you see this live-action demo, you’ll understand why.

Here’s the best part:

At the heart of this new technology is one company — 1/1,000th the size of GM.

If you want to get in on the electric car revolution, this is easily the best way to do it.

Click here to see the full story.

Sincerely,

Matt McCall

Senior Investment Strategist, InvestorPlace