By Money & Markets Editorial Team, Money & Markets, LLC, 2024-07-08

Since November 2022, the world has been buzzing with talk of artificial intelligence.

We've seen that in the stock market, too, with companies like Nvidia Corp. (Nasdaq: NVDA) posting huge gains since the general public's release of AI chatbot ChatGPT.

It stands to reason that three of the top four performing exchange-traded funds in the first half of 2024 are related to semiconductors.

After all, semiconductor components, like graphics processing units, are essential for AI and machine learning tasks.

What might surprise you is that the best-performing ETF in the first half of 2024 doesn't have much to do with AI at all:

An examination of nearly 200 ETFs shows that the Grayscale Bitcoin Trust (NYSE: GBTC) outperformed all other ETFs with a 61.1% gain in the first six months of 2024.

Granted, a lot of GBTC's gain came in the first three months of the year as the ETF pared back — along with the price of bitcoin.

The other three top-performing ETFs were either related to semiconductors (SMH and SOXQ) or the so-called “Magnificent Seven” stocks (MAGS).

Make no mistake that AI stocks outran the broader index in the first half of the year. The S&P Kensho Artificial Intelligence Enablers & Adopters Index had a 27.5% gain over the first six months, while the S&P 500 moved 14.5% higher.

Speaking of major indexes…

Nasdaq Rules the Roost In the First Six Months of 2024

AI hype has helped the technology sector of the market.

So much so that the tech-heavy Nasdaq Composite Index reached new highs as the first half of the year came to a close.

All three major indexes suffered a sluggish start to the year, but the Nasdaq (green line in the chart above) surged up 18.4% — thanks to large gains from:

The S&P 500's 14.5% jump in the first half of the year was propelled by NVDA and CEG, but also from:

Then, you have the laggard of the group — the Dow Jones Industrial Average. The Dow managed just a 3.9% return in the first six months. Its gains were helped by:

But, they were hurt by:

Pro tip: Matt recently covered the fall of Boeing in a recent essay. You can check it out here.

One thing to note is that the Russell 2000 gained just 1.7% over the first six months of the year, while the Russell Microcap Index was down 0.9%.

We've looked at broad ETFs and the performance of the three major U.S. indexes. Here's one more deep dive into the first half of 2024:

AI Drives S&P Sector Performance

Stocks like NVDA, AVGO, META, GOOGL and MSFT all outperformed the S&P 500 in the first half of 2024.

Of course, this is all due to the aforementioned AI buzz.

To drive that home, between March and May 2024 — the height of first quarter earnings — 199 S&P 500 companies cited AI in their earnings reports. The 5-year average is just 80 companies.

Twelve of those companies mentioned the term AI at least 50 times.

With AI being a huge catalyst in stock gains over the first six months of 2024, it should be no surprise what sectors of the S&P 500 enjoyed the biggest returns:

Ten of the 11 sectors of the S&P 500 saw gains in the first half of 2024. The IT and communication services sectors rallied 27.8% and 26.1%, respectively, far outpacing any other industry.

Looking at value vs. growth, large-cap growth grew 20.7%, while large-cap value was up 6.6%.

Now that we've taken a comprehensive look at the last six months, we can look ahead to the rest of 2024.

2024 Second-Half Preview: Is the Glass Half Full?

None of us have a crystal ball. There's no way to tell with exactitude just what the rest of 2024 has in store.

There's a ton of outside factors that could (and will) have an impact on the stock market:

- 2024 elections.

- Inflation data.

- Fed rate decisions.

The case for a market pullback is if we continue to see a divergence in where the gains in the first half of the year came from.

In the chart above, you saw IT and communication services far outpace every other sector of the S&P 500. No other sector broke double-digit gains.

If that divergence continues to widen, the market could be at risk for a slowdown. The same holds true if inflation or labor market data force the Fed to halt any rate cutting by the end of the year.

But, if we start to see the rest of the market catch up to the AI buzz that pushed IT and communication services to large gains in the first half, the rally has a good chance of continuing through the end of the year.

Even if the Fed elects to cut rates just once this year, that would be good news for this market rally, but the inflation and labor data has to support that kind of a move.

According to Bloomberg, since the early 1950s, when the S&P 500 rose more than 10% in the first half of the year, it averaged another 10% rally in the second half.

But there are too many factors at play to confidently suggest history will repeat itself.

What Makes Grayscale Bitcoin Trust (GBTC) Outstanding?

Banyan Hill research analyst and resident crypto expert, Andrew Prince, shares his insights on GBTC‘s runaway success in 2024:

Investing in bitcoin (BTC) was always a bit challenging for new investors…

At the very least, you had to learn the ins and outs of using a crypto exchange like Coinbase, in addition to your regular brokerage.

It was easy to get overwhelmed with concepts and terminology like “hot wallets” or “recovery passphrases.”

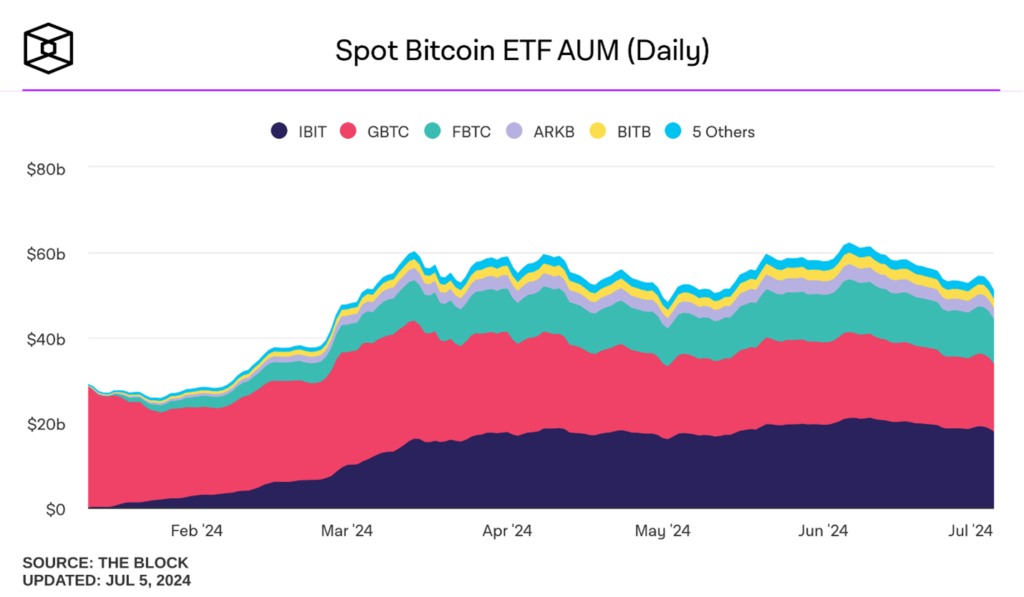

All that changed on January 10 this year, when the SEC approved 11 spot bitcoin ETFs for trading in the U.S.

But not all of these ETFs are equal. One in particular has been in the game far longer than its competition…

Investors have been able to trade the Grayscale Bitcoin Trust (GBTC) as an exchange-traded note (ETN) since 2013.

While the January 10 decision allowed other asset managers to create a bitcoin ETF, it allowed Grayscale to convert GBTC from an ETN to an ETF.

Right from the start, it announced that it would charge a 1.5% fee for this ETF. This is considerably higher than most other bitcoin ETFs, which charge between 0.12% and 0.25%.

This caused some investors to exit GBTC in favor of cheaper bitcoin ETFs.

But when asked if they would consider lowering fees, Grayscale wasn't worried.

It said GBTC‘s value lies in market-leading liquidity, tight spreads, high trading volumes and a decade-long track record of operational success.

And it's true.

Grayscale has weathered some of the worst storms in crypto over the last decade, managing to safeguard its investors' assets through all of it. That comes with a level of trust that many investors believe to be worth the higher fee.

And that's why, even after all the outflows from GBTC, today it's still the second-largest bitcoin ETF with $15.96 billion in AUM, second only to Blackrock's IBIT. (As seen in the chart below.)

Andrew Prince

Research Analyst, Banyan Hill Publishing

The post 2024's Best-Performing ETF (Might Surprise You) appeared first on Money & Markets, LLC.