This story was originally published here.

Investors need to ask how their portfolios will fare during times of crisis. When the S&P 500 takes a dive, will their investments dive along with it or hold up and even rally?

My approach in my Profitable Investing is to present an allocation to both stocks and fixed income. This combination provides growth and income, and helps portfolios absorb the shock that comes from the stock market’s gyrations.

This comes with lots of dividend income from my recommended stocks as well as the heavy income from coupons and interest paid by bonds, preferred stocks and related funds.

But it’s important to gain further perspective on what investments work better during selloffs. It only takes a few bits of financial history to see what worked when the S&P 500 wasn’t your friend.

Crisis Investing in the Fourth Quarter of 2018

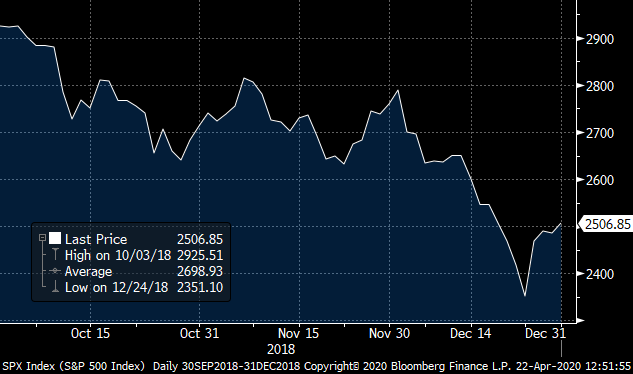

The fourth quarter of 2018 was very bad for the general stock market. The S&P 500 lost 19.3% in price through Dec. 24 of the quarter. What set the selling off was the concern that sales and earnings growth of the underlying companies were less likely to rise. And in turn, everyone started selling.

This was exacerbated by the erroneous actions by the Federal Reserve and its Open Market Committee (FMOC) to tighten money conditions. But inflation — as measured by the core Personal Consumption Expenditure (PCE) index — was not sustainably above the FOMC’s target of 2%.

The benchmark Fed Funds rate went from 1.4% to 2.4%. And the reversal of some quantitative easing (QE) from the financial crisis added to credit market concerns. It also made things more expensive for S&P 500 member companies.

Source: Chart by Bloomberg

S&P 500 Fourth Quarter 2018

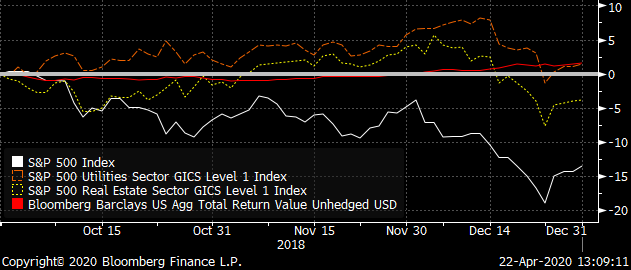

But some alternative investments fared much better. U.S. utilities — as tracked by S&P 500 — returned a positive return for the full quarter by 1.4%. And real estate investment trusts (REITs) returned a minor loss of 3.8%. The U.S. bond market — as tracked by the Bloomberg Barclays US Aggregate Index –returned 1.6%.

Source: Chart by Bloomberg

S&P 500, S&P Utilities, S&P Real Estate and Bloomberg Barclays US Aggregate Index Total Return

And another asset sector stood out. Gold — as tracked by the London morning fixing price — gained 8.3%. That’s interesting as U.S. short-term interest rates were on the rise and the U.S. dollar was gaining. The dollar did begin to retreat in December.

The fourth quarter was more of a normal correction or selloff. It was based on expectations for fundamentals, including sales and earnings. The selling that occurred in the first quarter of this year was in a totally different market.

First Quarter 2020

The first quarter of 2020 was brutal. The S&P 500 went from a high of 3,386.15 on Feb. 19 to a low of 2,237.40 on March 23. That’s a loss in price of 33.9%.

Source: Chart by Bloomberg

S&P 500 First Quarter 2020

The novel coronavirus was just entering the U.S. with companies that had exposure to China and Europe seeing the initial impacts on their businesses. But the ensuing lockdowns did something that has never happened in the U.S. economy — they brought a nearly full shutdown of business.

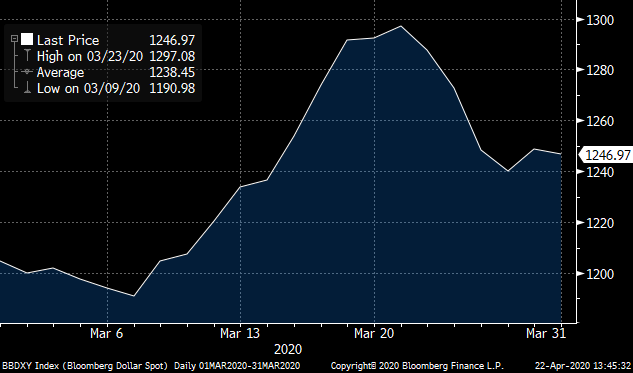

The result was that everyone only wanted to own U.S. dollars in cash. The U.S. dollar soared from March 9 through to March 23 from 1,190.98 to 1,297.08 amounting to a gain of 8.9%.

Source: Chart by Bloomberg

Bloomberg U.S. Dollar Index

The Federal Reserve jumped in to this mess, working even in the fourth quarter of 2019 to ease credit troubles in the repurchase agreement market.

And the Fed expanded into lending in the commercial paper market where corporations borrow and invest for overnight and short-term periods. But with necessary credit guarantees from the U.S. Department of Treasury, the Fed began to buy all sorts of bonds and credit securities.

The S&P 500 has been reflecting the forward-looking optimism that lockdowns will end and that there will be some sort of recovery.

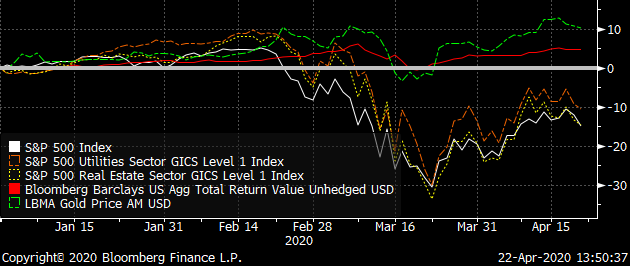

Source: Chart by Bloomberg

S&P 500, S&P Utilities, S&P Real Estate, Bloomberg Barclays US Aggregate and London Gold Fixing Total Year-to-Date Return

And the S&P 500 has regained some of the heavy losses. As just noted, during the heavy selling and the drive for cash, investors sold everything.

But on a year-to-date total return, utilities, REITs, U.S. bonds and gold have all outperformed the S&P 500 with lower losses, or in the case of bonds and gold, gains in return.

This shows the power of dividends as well as the current fundamental attraction of gold given the huge drop in U.S. short-term interest rates and the pullback and drop in the U.S. dollar.

Editor's Note: To keep reading and get all 11 plays, click here.

65 Unique Ways ANYONE Can Make Extra Cash (Without Getting a Second Job)

Are you looking for great sources of real income, without having to get a second job?

Then keep reading, because author Neil George wants to send you his new book that profiles 65 simple ways to earn large amounts of work-free income.

…extra cash that you can collect ON TOP of your Social Security check…

…without messing around with crappy jobs. (Pizza delivery driver? No way.)

These are PROVEN cash-gushing strategies… the kind typically used by the wealthy elite.

And the best part…

Neil George has set aside copies of his book, Income for Life, and he’s willing to send you a hardback version today, ABSOLUTELY FREE (just pay shipping).

(Just 517 copies left, so click here to claim yours before it's ripped away.)

Here's just a sample of what you can find inside:

- Learn the secret of the $50,000 lump sum Social Security check. Seriously, it couldn’t be easier!

- Use what Neil calls the “F.H.A. Loophole” to get the government to pay your mortgage – PLUS receive hundreds in extra cash on top.(Page 217)

- Collect $100s for pictures in Old Family Photo Albums! Believe it or not, there is an easy way to turn your old artwork/photographs into $100 bills (certain businesses are desperate). (Page 297)

- Get paid every time your favorite song gets played on the radio! This little-known website allows you to tap into royalty payments every time your favorite song is played on the radio. Some lucky folks collect thousands of dollars a year! (Page 307)

- Pocket upwards of $197 PER HOUR simply by taking a walk through the woods in the fall… or $137 while visiting your favorite beach in the summer… and many, many more!

Needless to say, this book has become highly sought after.

So if you don't claim your free copy of Income for Life today, we'll send it to the person behind you in line…